[ad_1]

This article is a part of an ongoing collection of data-driven articles from PocketGamer.biz and information.ai (previously App Annie) highlighting traits within the international cell video games sector utilizing information.ai’s Game IQ analytics.

Is the worldwide cell video games market dominated by just a few large gamers and their enormous franchises? It’s a subject that almost all recreation builders and publishers may have an opinion on. In the previous, it was definitely true that key titles constantly topped the charts, however in 2022, is there house for brand spanking new video games to earn money?

Using Game IQ’s complete breakdown of subgenres throughout the entire international market, splitting the information by area, it turns into clear that there are quite a few areas for alternative and disruption for brand spanking new video games and smaller builders/publishers.

Is the cell gaming market dominated by just a few large gamers?

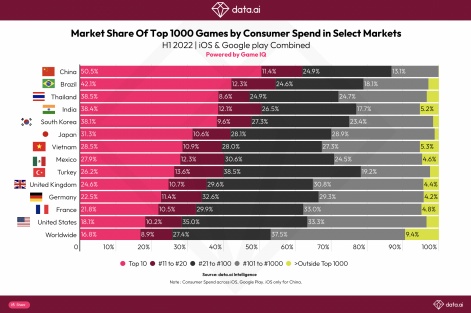

The cell market is house to a few of the largest recreation franchises on the planet, with the main titles producing billions of {dollars} yearly. However, trying on the income generated throughout the market as an entire, it may be seen that the highest 10 video games account for under 17 per cent of the overall shopper spend within the first half of 2022. An astonishing 65 per cent of the overall income comes from titles starting from 21 via to 1000.

This means that cell gaming stays as dynamic as ever, with loads of room for recent innovation and competitors from established publishers and newcomers alike.

The European and the US markets observe this pattern pretty intently. In the US for instance, the highest 10 video games account for 18 per cent of shopper spending, which suggests a big alternative for titles exterior the highest 20 hits to carve out substantial market share.

However, this varies massively in keeping with area. In Brazil 42 per cent of the overall spend goes on the highest 10 titles, whereas in China 50 per cent goes to the main video games. So for builders working in these markets, it’s very important to make use of instruments reminiscent of information.ai to know the aggressive panorama, determine companions, and undertake applicable construct and purchase methods.

Let’s get granular

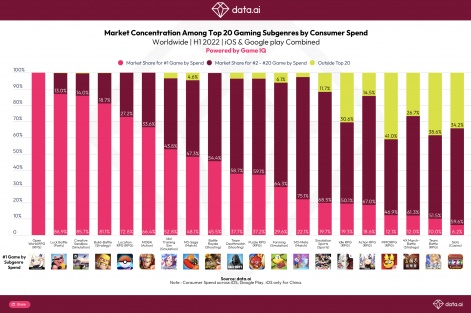

If we dive into the main points of every style and subgenre, we are able to discover out extra about every class and recreation sort. We can see precisely how dominant the highest titles are inside that subgenre by way of shopper spend. We can discover out which areas of gaming are extra saturated than others and the place the alternatives exist for brand spanking new and breakthrough hits.

By visualising the information, we are able to see that these alternatives differ wildly throughout the completely different classes. For builders and publishers hoping to enter the cell market and obtain business success, the selection of recreation sort may have a big impact on the probabilities of success.

The information displaying shopper spend by style reveals two edge circumstances – Open World RPG and Casino/Slots – highlighting these huge variations.

In the Open World RPG style, the key participant: Genshin Impact, accounts for 100 per cent of shopper spend. The different closest genres – Luck Battle, Creative Sandbox and Build Battle – additionally skew equally, with the main video games bringing within the majority of the income.

However, on the different finish of the market, the Casino/Slots subgenre reveals a much more numerous vary of income era, with a mere six per cent of shopper spend coming from the highest title. This makes the class much more open, and aggressive with potential for profitable new entrants.

While on the floor this may very well be seen as problematic, it’s truly potential to be constructive about each situations. A style through which the main title is the dominant income driver is open to disruption as soon as the recognition of the sport wanes, Meanwhile, these subgenres with extra distributed income mills point out a participant base open to innovation and new entrants – a brand new recreation, new style or new gameplay mechanics.

Download Now

DATA.AI’s Q2 2022 Mobile Market Pulse Top Apps and Games provides even higher perception into the worldwide cell markets and the efficiency of the main apps and video games in key areas worldwide. The report is accessible free and might be downloaded right here.

Find Out More

If you’re having fun with the insights from information.ai, you’ll be able to pay attention in to the corporate’s new Game Changers podcast, which takes a deep dive into completely different facets of the worldwide cell video games market.

[ad_2]