[ad_1]

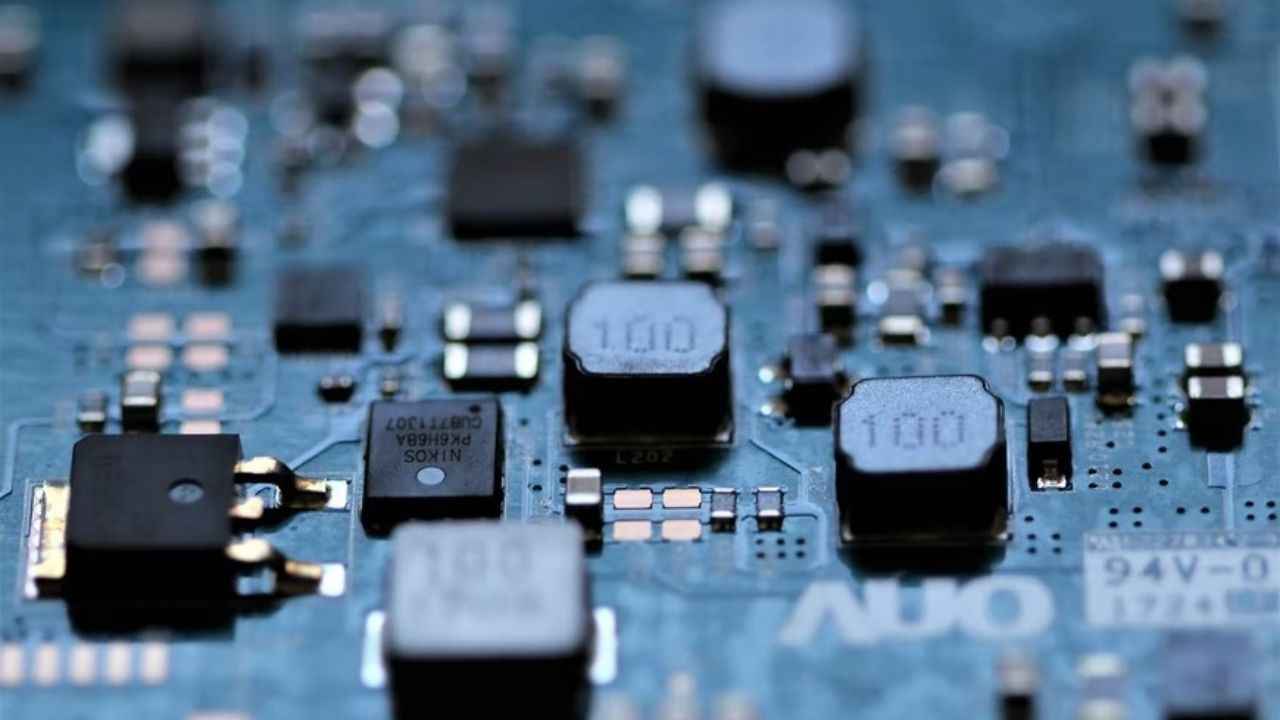

The scarcity of semiconductor chips that goes into numerous objects to normalise someday in subsequent yr whereas the lead instances proceed at a better stage, Moody’s Analytics mentioned in a report.

“While we see lead instances remaining elevated via the top of the yr, we anticipate the chip scarcity to normalise someday in 2023,” mentioned the report.

According to Moody’s Analytics, final month was the primary time for the reason that begin of the pandemic the lead time fell from 27.1 weeks to 27 weeks.

“While the decline is notable given the upward pattern in lead instances up to now couple of years, 27 weeks remains to be removed from the norm, and we anticipate lead instances to stay elevated going into 2023,” the report notes.

Creating new provide for chips is a multiyear course of and includes important time and assets to construct a brand new foundry/plant.

There can also be important lead time in acquiring the lithographic machines wanted to make the chips themselves.

According to the report, contemplating the chip scarcity, many corporates resorted to ordering greater than they wanted, leading to extra stock.

At the core of the chip scarcity is the truth that many of the world’s superior chips (dimension 7 nano metre, or nm, and fewer) aremanufactured in Taiwan and South Korea, and there are important entry prices to penetrate this market, mentioned the report.

“To put this in perspective, China has spent greater than $10 billion over the previous decade investing in its semiconductor trade, and its largest producer solely not too long ago introduced that it’s lastly capable of produce 7nm chips, although the frontier has already moved to a lot smaller chip sizes,” the report notes.

Even for corporations just like the Taiwan Semiconductor Manufacturing Co. and Samsung it takes years earlier than they’re able to construct a brand new foundry, or plant for making chips.

That aside, the geopolitical scenario may additionally have an effect on semiconductor manufacturing.

According to Moody’s Analytics, China has restricted sand exports to Taiwan following the go to of Speaker of the US House of Representative, Nancy Pelosi to Taiwan. China may limit different exports essential to chip manufacturing if the scenario escalates.

The different geopolitical occasion that has important ramifications for the chip scarcity is the Russian invasion of Ukraine.

Both nations are important producers of neon, palladium, helium and different inputs vital for chip manufacturing. The cause this has not disrupted the chip provide chain extra radically is as a result of some chipmaking corporations have lithographic machines that recycle greater than 80 per cent of the neon and noble gases utilized in manufacturing. It stays to be seen whether or not this may have a extra materials affect if the army battle persists.

Moody’s Analytics see some divergence within the demand and provide stability for numerous chip functions. Chips used for networking, optimum and telecommunications tools are briefly provide field-programmable gate arrays have lead instances in extra of fifty weeks.

By distinction, microcontroller items in addition to energy and reminiscence chips have seen a number of the largest declines in lead instances.

“We anticipate lead instances and costs for reminiscence functions to stabilize, however can see costs and lead instances rising for discrete and analog functions if the aforementioned manufacturing pressures proceed,” Moody’s Analytics mentioned.

(Except for the headline, the remainder of this IANS article is un-edited)

For extra know-how information, product critiques, sci-tech options and updates, preserve studying Digit.in.

[ad_2]