Getty Images

Ben Langhofer, a monetary planner and single father of three in Wichita, Kansas, determined to start out a aspect enterprise. He had made a handbook for his household, laying out core values, a mission assertion, and a structure. He needed to assist different households put their beliefs into an actual e-book, one they may maintain and show.

So Langhofer employed net builders about two years in the past and arrange a web site, buyer relationship administration system, and cost processing. On Father’s Day, he launched MyFamilyHandbook.com. He’s had some modest success and has spoken with bigger teams about bulk orders, however enterprise has been largely quiet to this point.

That’s how Langhofer knew one thing was unsuitable on Friday, August 11, when a girl from California known as a couple of fraudulent cost. He checked his service provider account and noticed almost 800 transactions.

“My coronary heart, it sunk,” Langhofer instructed Ars on Thursday. He instantly contacted his cost vendor Stripe, who he stated instructed him about card testing—a scheme by which on-line card thieves use tiny costs from an account to check for legitimate playing cards. Stripe stated it will problem a bulk refund, Langhofer stated. Knowing his cost processor was conscious of the difficulty, he went about his weekend.

Langhofer awoke early Monday morning to a flurry of missed calls.

He stated his web site had tried almost 11,000 extra transactions, every for $1, most of them initiated by e-mail addresses minutely completely different from each other. Many of them concerned Ally Bank playing cards, Langhofer stated. He’d solely ever had two telephone calls to the forwarded quantity listed in his on-line retailer, however now his telephone would not cease ringing.

“My dad at all times taught me to have title, so this hurts,” he stated. “I haven’t got an enormous workers, however I’ve a fantastic title in Wichita, on this state. Now my enterprise is tied up on this, and I do not know what’s subsequent.” In textual content messages earlier than an Ars Technica interview, Langhofer stated the ordeal “consumed my complete week and precipitated extra panic than I recall having in a very long time.”

For sale: debit playing cards, barely used

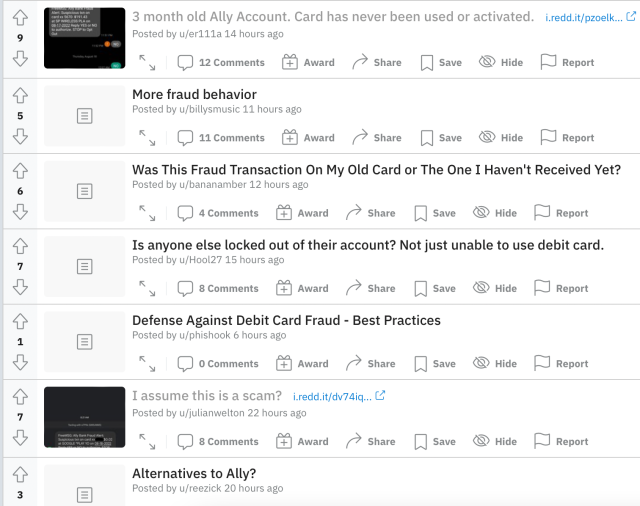

Langhofer’s enterprise seems to be a sufferer in a sequence of fraud that has affected 1000’s of debit card prospects over the previous week. Most distinguished amongst them are Ally Bank prospects, who’ve been tweeting and posting within the r/AllyBank subreddit about costs on playing cards, some they’ve by no means activated or used. They’ve reported (and Ars Technica has seen) telephone help wait occasions of as much as an hour or extra.

There’s an awesome sentiment that one thing is going on, however for days, the foremost events had but to verify something.

(Update 4:56 p.m.: A spokesperson for Ally Bank stated in an announcement: “Across the board, the monetary companies business is experiencing an uptick in debit card fraud exercise brought on by unhealthy actors.” The assertion famous that unauthorized transactions reported inside 60 days of an announcement will end in a brand new card and refunded costs.

The assertion added: “Call facilities are experiencing longer-than-usual wait occasions on account of nationwide staffing challenges together with a rise in name volumes. This isn’t distinctive to Ally.”)

Two of these questioning what’s taking place are Stephen Fuchs and Curt Grimes, a Chicago-area couple who spoke with Ars Technica and shared their documentation. They opened their joint Ally checking account in March 2022. Both had debit playing cards tied to it, every with completely different numbers. Fuchs by no means activated his card. Up till final week, Grimes had solely used his card as soon as, to ship about $5 to somebody by way of Apple Cash.

On August 10, a cost for $15 from a unusual software program web site appeared on certainly one of their playing cards, however it went unnoticed. On Friday, August 12, Grimes acquired an SMS fraud alert from Ally, alerting him to costs from two completely different Shopify shops for almost $200. Grimes flagged the fees as fraudulent, and Ally (and Apple Pay) reported that the cardboard was suspended. After spending virtually an hour ready on the telephone for Ally on Saturday, August 13, Grimes disputed the sooner $15 cost and noticed in his Ally app {that a} new card, with a brand new quantity, was on its manner.