[ad_1]

The Huge Image

Decentralized finance is one in all, if not the driving theme behind Blockchain & Co. Non-Fungible Tokens, or NFTs, is one other driver.

In a minimum of the final 5 revealed articles, I’ve talked concerning the potential of mixing gamification and NFTs. I’m satisfied that the usage of gamification within the service of NFTs and likewise the usage of NFTs within the service of gamification have an thrilling future.

If you’re on this mixture, you could find all about it right here.

But when decentralized finance (DeFi) performs such a giant function within the blockchain universe, what does it seem like when DeFi meets NFTs meets Gamification? That’s what we’re taking a look at proper now.

Half 1

What’s Occurring

Decentralized finance means one factor above all: in idea, each single one in all us now has entry to a monetary system. As a result of, firstly, now you can make investments with as little as ten euros and, secondly, you are able to do so by and huge with out administrative or different hurdles.

Decentralized finance, or DeFi, is a system by which monetary merchandise turn out to be accessible on a public decentralized blockchain community. That makes them open to anybody to make use of, reasonably than going via middlemen like banks or brokerages. In contrast to a financial institution or brokerage account, a government-issued ID, Social Safety quantity, or proof of tackle should not vital to make use of DeFi.

https://www.investopedia.com/decentralized-finance-defi-5113835

We won’t clarify DeFi intimately now as a result of there are already really superb articles for this. For instance right here or additionally this video. Nevertheless, I’ll pick one level right here so as to have the ability to present an fascinating interplay between DeFi and gamified NFTs on the premise of this one instance.

This one level is the collateral.

Go Deeper with Gamified NFTs as Collaterals for DeFi

On this planet of decentralized finance, there are completely different merchandise. Nevertheless, one factor stays the identical in comparison with the normal monetary system. There may be the celebration that gives monetary liquidity and the opposite celebration that seeks or desires that liquidity, as to say, a mortgage.

And to be able to be allowed to take out a mortgage, you additionally need to deposit collateral right here. That is the place among the variations between decentralized finance and the normal monetary system begin to turn out to be clear.

Within the DEFI world, there are additionally new methods of depositing collateral. Mainly, something that’s accepted as collateral by potential lenders and may be mapped in a technique or one other within the blockchain can now perform as collateral.

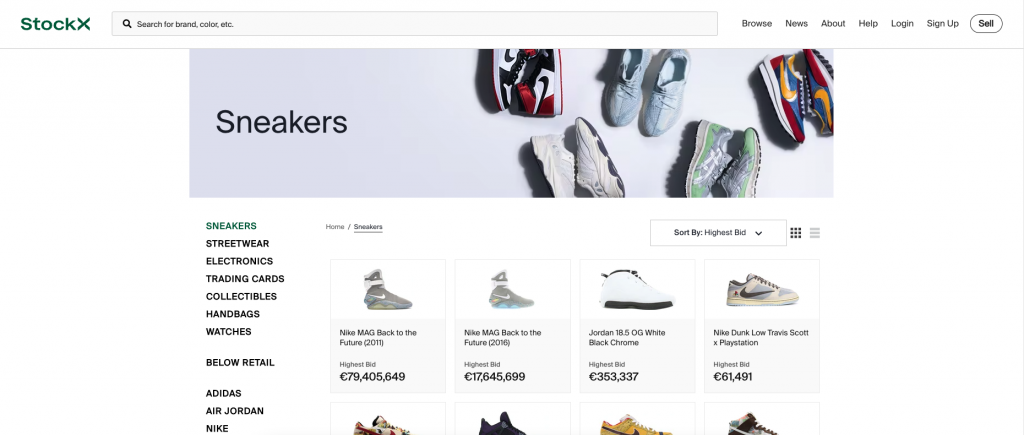

Theoretically, this can be, for instance, pair of sneakers, that are traded in the marketplace by collectors with a sure worth.

Do you know that there’s an official sneaker alternate right here, the place sneakers are traded in values of tens of 1000’s of {dollars}?

Since there may be even some worth stability for a few of these pairs of sneakers, this might thus be accepted as collateral.

DEFI instance with sneakers as safety

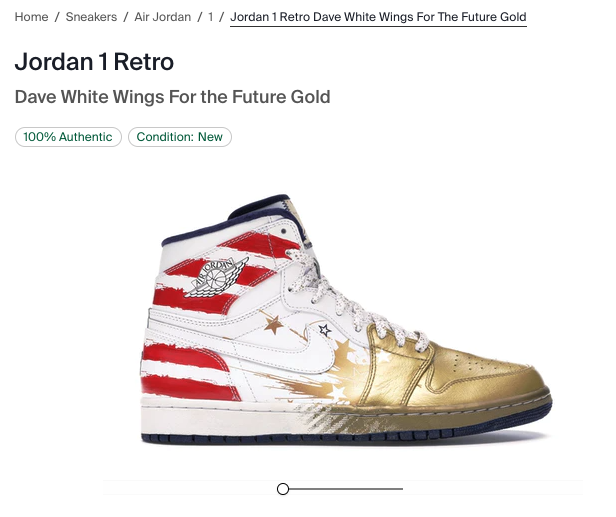

So let’s assume somebody owns a pair of Jordan 1 Retro. On the inventory alternate, this pair of sneakers has a median retail worth of € 16,665.

With such extraordinary collateral, which is after all extra risky and likewise extra illiquid than financial safety, gold, actual property, or related, the mortgage to ratio worth will probably be a minimum of 300%. Because of this with a median sale worth of about 16,665€, the utmost mortgage that may be obtained is about 5,500€. However that is already the higher restrict and if the value of the sneakers drops slightly, the safety is now not adequate and the mortgage could be liquidated. As it is usually the case within the traditional credit score system.

In order that this doesn’t occur so shortly, we set ourselves a buffer and assume a loan-to-value ratio of 600%. So we take a mortgage of a most of approx. 2.700€.

So with that buffer within the collateral, the worth of the pair of sneakers ought to drop by about 50% earlier than the loan-to-value ratio turns into inadequate and we’d be liquidated.

The thrilling factor right here, after all, is that such a process wouldn’t be doable within the classical monetary system. No financial institution will settle for a pair of sneakers, regardless of how distinctive and helpful, as collateral for a mortgage.

Nevertheless, to be able to take part within the DEFI market, on this case, the pair of sneakers should be transferred to the blockchain universe to turn out to be collateral for a doable mortgage.

However, wait…

Let’s make clear a query that at all times comes up in a short time at this level: Why all this?

Why go to all the difficulty of utilizing collateral to borrow liquidity when you possibly can flip the collateral itself into money?

This query is justified and turns into much more urgent when the collateral itself already has a financial character, like crypto.

In brief, since you don’t need to hand over the precise collateral – just like the pair of sneakers on this case, or since we’re within the blockchain universe, cash like BTC, Ethereum, and others.

Let’s say you personal bitcoin price €10,000.

Now you want to take part within the DeFi market with 2,000€ and make investments it there. Nevertheless, you might be additionally satisfied that Bitcoin will proceed to rise and subsequently don’t need to promote it to get your 2.000€ for the preliminary funding. In such a scenario, it is smart to deposit the ten,000€ Bitcoin as collateral, borrow 2,000€ towards it after which make investments it.

If Bitcoin now rises in worth, your collateral grows, too. For instance, to 12,000€. This implies now you can borrow slightly extra towards it, or you may go away it and thus improve your safety and likewise scale back the danger of potential liquidation.

In case you have then paid again the two,000€, you get your Bitcoins again and thus additionally profit from the grown worth to 12,000€.

After we now have clarified this query, let’s return to the actual fact of how we will switch these pairs of sneakers as collateral on the blockchain.

Okay, so we now have now roughly defined how on the planet of decentralized finance anybody can bounce proper in.

Both straight with the smallest quantities, even with 10€, or not directly, through which one deposits an asset as collateral after which takes out a mortgage for it.

And all this with out banks, and with a lot decrease hurdles.

That is the place the NFTs come into play.

To do that, you create an NFT (you may examine how this works technically right here, for instance), which is taken into account the digital twin of the sneaker pair. In fact, this requires an official physique that acts because the NFT creator and is trusted by all market individuals. This already exists for the actual property market and likewise the traditional automobile market. Even when I don’t know this for the sneaker market but, a longtime participant like stockx.com would undoubtedly be appropriate for this.

You ship your pair of sneakers to stockx.com in order that it could actually act as an middleman and certify their authenticity and possession. To do that, stockx.com points an NFT that features the serial variety of the sneakers, the date, the title of the proprietor, and the present worth of the footwear. Via so-called oracles, which may retrieve the present worth of the sneakers straight from the inventory alternate, this worth may even be mapped in real-time within the NFT.

This NFT is then despatched to the proprietor of the footwear on his digital pockets, from the place he can deposit the NFT once more at a DEX (decentralized monetary alternate), as safety.

In the long run, NFTs are an efficient solution to characterize digital belongings to allow participation in a DEX as collaterals.

This inevitably brings us to the preliminary and remaining query of how gamified NFTs may be of profit right here.

Half 2

The extra and motivated one is to take part within the decentralized monetary market, the extra thrilling turns into the query of the kind and worth of the doable collateral to be deposited. Partly 1 we talked about how maybe sooner or later a pair of sneakers might be deposited as collateral.

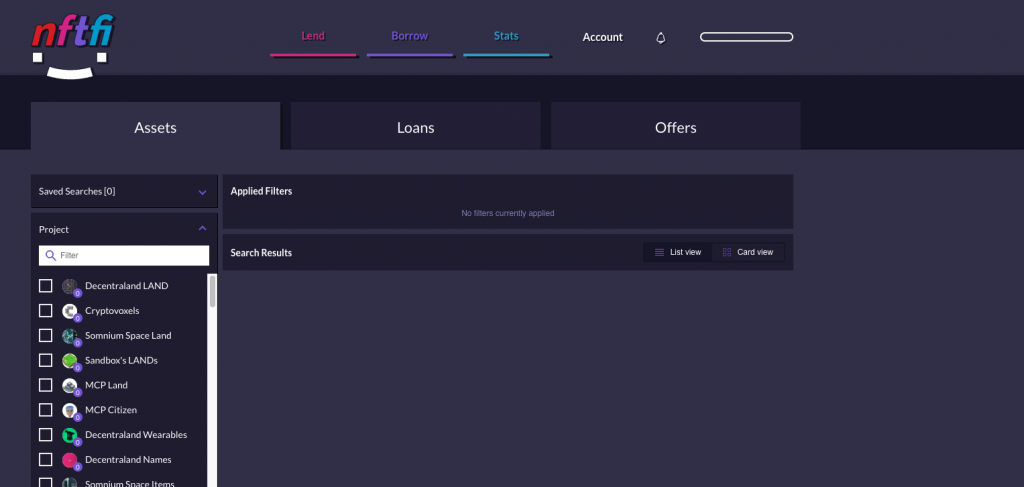

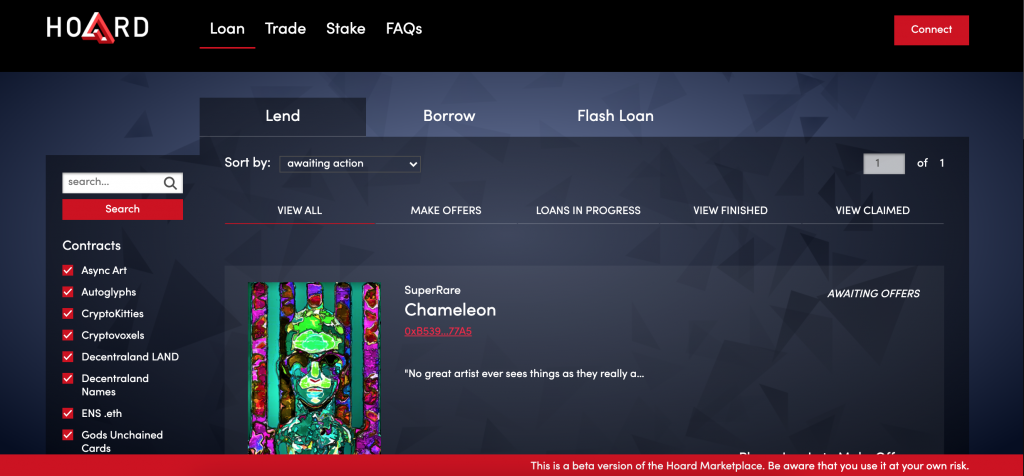

Companies that understood and anticipated this development early on are e.g. NFTfi.com and the Hoard Market.

Right here you may deposit your individual NFTs as collateral from chosen NFT initiatives and thus get a mortgage.

-

screenshot from nftfi.com -

With the growing success of NFTs and adaptation by the plenty, different providers will definitely provide the same service right here.

And that brings us to gamified NFTs.

By and huge, all NFTs may be kind of gamified.

To see how gamification may help NFTs right here, let’s look briefly on the mission and traits of gamification.

Gamification makes use of comparable mechanisms which might be already used natively in merchandise reminiscent of on-line video games, board video games & card video games. You may as well discover these mechanisms curiously in actions like sports activities, music, or your interest. In different phrases, in all places the place persons are predominantly lively voluntarily.

These mechanisms are so fascinating as a result of they make it simpler for us people to have interaction with duties natively and intuitively.

Now as we’re wanting right here on the subject of NFTs as collaterals, I can inform you that gamified NFTs might be a secret weapon to construct up helpful collaterals.

This occurs particularly within the context of progress and achievements. We have now already lined the ability of Gamification and the way it works e.g in this Youtube channel.

The extra helpful an NFT is, the extra appropriate it’s as collateral. This isn’t solely concerning the pure nominal worth, but additionally relying on the low volatility of the worth and that as many individuals (or lenders) as doable see the identical.

The worth of an NFT may be decided both by its (in my trustworthy opinion)

- de facto inherent financial worth

- worth created by demand & provide

- rights and privileges related to an NFT.

Let’s make clear these three potentialities:

De Facto Inherent Financial Worth

That is the only and most direct choice. Assume that the NFT stands for a direct financial worth. Let’s assume, for instance, that it’s a 10 Bitcoin NFT. Thus, it will be clear, this NFT comprises a personal key to a pockets with 10 Bitcoin. This may make the worth of the NFT as collateral very straightforward to find out and likewise to confirm. Since you possibly can deposit the ten Bitcoin as collateral your self, this could not essentially be a smart strategy, however I feel the concept behind it’s clear.

Worth Created by Demand and Provide

That is the traditional instance of a Samuel NFT. The very best – present – instance here’s a Crypto Punk NFT or a Board Ape Yacht Membership NFT. However for instance additionally a digital NBA Topshot buying and selling card.

For this type of NFTs there are official marketplaces with a full of life neighborhood. And since the pricing between provide and demand may be very clear right here, you may simply discover out the worth of such an NFT in real-time.

Rights and Privileges Related With an NFT

Relying on the circumstances set by the NFT creator or proprietor, you may carry out and fulfill duties to ‚cost‘ your NFT with attributes. You’ll be able to think about this just like an avatar from a web based sport. Relying on the actions of the participant, this develops additional. He turns into stronger, will get extra assets, new expertise and even handicaps and challenges. Precisely the identical can apply to NFTs.

Let’s think about that the music band U2 releases 100 NFTs. These NFTs present entry to numerous songs from the start that has not been launched earlier than. So, due to the NFT, you get early entry to a couple of the brand new songs from the subsequent album.

To get these NFTs, you had to purchase them at public sale on one of many NFT exchanges, e.g. opensea.com.

Now, that is only the start of U2’s loyalty program.

With the receipt of the NFTs additionally got here an inventory of challenges that one can go as a real U2 fan. Examples could be:

- visiting outdated U2 venues

- gathering all U2 albums

- commenting and sharing articles about U2

- filling out sure questionnaires from live performance promoters

- customizing your social media profile image with a ready U2 signal

- and far more.

There are nearly no limits to creativity right here.

With every achievement of one in all these challenges, you get chosen privileges or entry to new challenges.

There may be rewards which might be reasonably ’easy‘ like entry to digital information, data, or the like. However there can be very privileged achievements like

- a 1-hour skype name with the band members

- one-time backstage entry at a U2 live performance of your selection

- perhaps even a lifetime live performance ticket because the #1 prize

- 10% low cost in your buddy’s ticket

- entry to discord or slack channel the place solely the highest 50 folks can see and vote on the brand new album cowl

- and lots of extra. Get loopy.

The proprietor of such an NFT can thus additional develop the NFT via his personal actions and, in accordance with the privileges thus obtained, additionally improve its inherent worth.

Deposited as collateral, the worth of the collateral has thus the potential additionally to extend and so, one may borrow a better credit score towards it. Or enhance his personal loan-to-value ratio.

Be Sensible And Use Gamified NFTs For Engagement

An issued gamified NFT is like an invite (and a guide on the identical time) from a model/individual/group to its customers & followers learn how to expertise a journey collectively, and the way to have the ability to progress inside this journey in a game-like method. This game-like asset is the key to creating one thing that permits long-term engagement inside communities that advantages from the intrinsic want of individuals to be a part of one thing larger and to earn your home in it.

Consider such an NFT because the visible illustration (just like an avatar in a sport) of a buyer’s private actions in a designed journey.

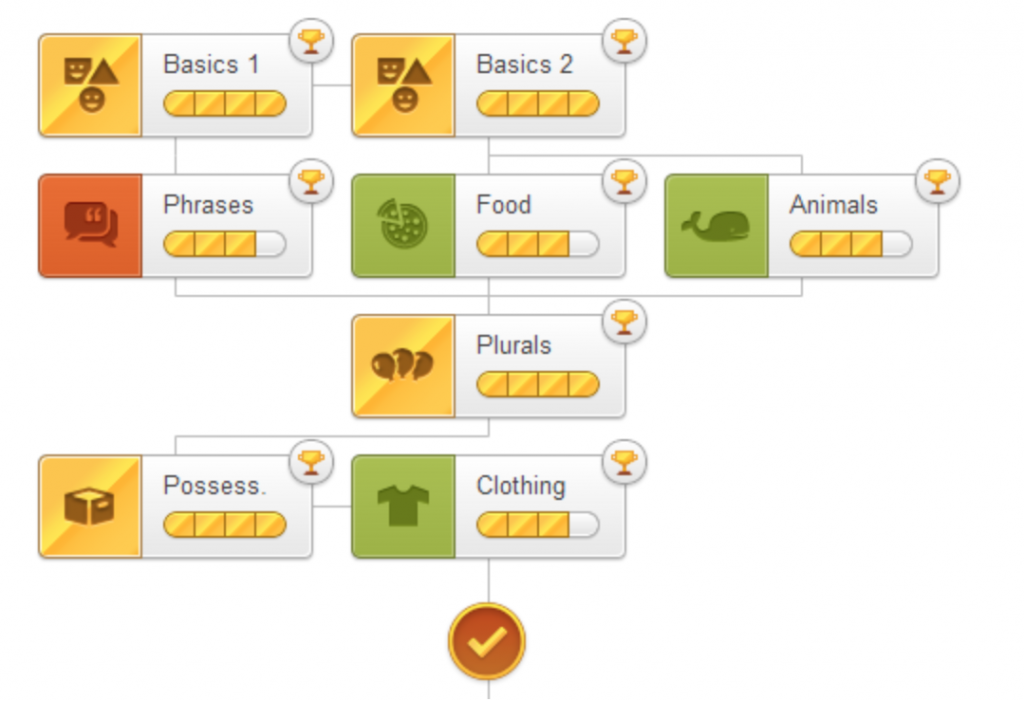

For instance, you may design such a journey like a progress tree that unfolds over time in entrance of the participant (buyer).

Right here is a straightforward visualized progress tree from the language studying app Duolingo:

As you full set duties and go challenges(!), you progress up the progress tree. On the identical time, your individual NFT, as a consultant avatar, costs up with the talents you’ve gotten acquired.

In line with its specificity and worth for a selected neighborhood, the worth of this NFT can improve accordingly.

Taken by itself, this already creates a neighborhood administration design that frees itself from the dependence on traditional extrinsic reward techniques. As a substitute, it depends, just like the function mannequin of video games, on the joint completion of thrilling challenges inside the framework of a superordinate story.

Be Even Smarter and Use it Additionally as a monetary Asset

Within the context of the DeFi mentioned on this article, nevertheless, we now have an extra alternative to show this dedication as a buyer or fan right into a liquid asset. By growing the worth of the NFT via our gamified actions, we enhance its place as collateral and might thus lend a safer mortgage towards it, which in flip can present returns on the DeFi market. Both by staking, by liquidity mining, by lending or straight promoting the complete NFT, or particular person belongings from the NFT, on the identified NFT exchanges.

On this sequence of Gamification & NFTs have already appeared:

[ad_2]